Accounting for Managers - प्रबंधकों के लिए लेखांकन

- Description

- Curriculum

- Reviews

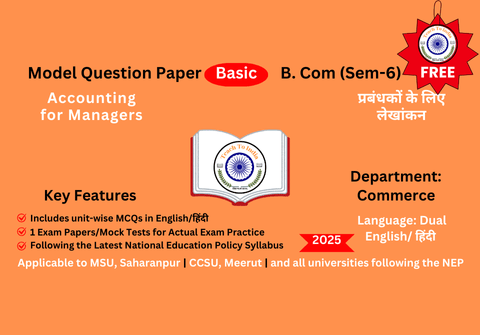

Model Question Paper

Accounting for Managers – प्रबंधकों के लिए लेखांकन

Key Features | मुख्य विशेषताएँ

- Bilingual Model Paper | द्विभाषी मॉडल पेपर

- Enough MCQ for Practice | अभ्यास के लिए पर्याप्त MCQ

- Exam Practice Paper with Mock Tests | मॉक टेस्ट के साथ परीक्षा अभ्यास पत्र

- Latest Syllabus as per NEP | NEP के अनुसार नवीनतम पाठ्यक्रम

- Designed by Experts | विशेषज्ञों द्वारा तैयार किया गया

The given MCQs cover only 10% of the syllabus | दिए गए बहुविकल्पीय प्रश्न केवल 10% पाठ्यक्रम को कवर करते हैं।

To cover 100% of the syllabus with summaries, upgrade to our Advanced Model Paper.| पूरा सिलेबस और सारांश कवर करने के लिए हमारा एडवांस मॉडल पेपर जॉइन करें। Join Advanced Model Paper

|

Program Class: Degree/ B.Com. |

Year: Third |

Semester: Sixth |

||

|

Subject: Commerce |

||||

|

Course Title: Accounting for Managers |

||||

|

Course Learning Outcomes: · After completing this course a student will have: · Ability to understand the concept of Managerial Accounting along with the basic forms and norms of Managerial Accounting. · Ability to understand the terminologies associated with the field of Managerial Accounting and control along with their relevance. · Ability to identify the appropriate method and techniques of Managerial Accounting for solving different problems. · Ability to apply basic Managerial Accounting principles to solve business and industry related issues and problems. · Ability to understand the concept of Budgetary Control, Cash Flow Statement, Fund Flow Statement, Break Even Analysis etc. |

||||

|

Credits: 5 |

Core Compulsory |

|||

|

Max. Marks: 25+75 |

Min. Passing Marks: 10+25 |

|||

|

Unit |

Topics |

|||

|

I |

Management Accounting- Concept, Meaning, Characteristics, Difference between Financial Accounting Management Accounting, Difference between Cost Accounting and Management Accounting, Techniques, Objectives and Importance. Management Accountant- Duties, Status, Functions and Responsibility. Financial Statement Analysis and Interpretation – Meaning, Objectives, Characteristics of an Ideal Financial Statement, Parties Interested in Financial Statement, Types of Financial Analysis – Horizontal, Vertical and Trend Analysis. |

|||

|

II |

Ratio Analysis: meaning, Utility, Classification of Ratios – Profitability Ratio, Activity Ratio and Financial Position Ratios. Fund Flow and Cash Flow Statement- Concept, Meaning of the term Fund and Preparation of Fund Flow Statement and Cash Flow Statement (As-3). |

|||

|

III |

Business Budgeting: Meaning of Budget and Budgeting, Objectives, Limitations and importance, Essentials of effective Budgeting, Classification of Budgets- Flexible budget and Zero Based Budget. Marginal Costing: Meaning, Determination of Profit under Marginal Costing, Pricing of Product, make or by Decision, Selection of most profitable channel. Break Even Analysis: Concept and Practical Applications of Break even Analysis. |

|||

|

IV |

Standard Costing and Variance Analysis: Meaning and Objectives of Standard Costing Setting of Standard, Variance Analysis: Material and Labour Variance. Reporting to Management: Meaning, Objectives, Principles of Reporting, Importance of Reports, Classification of Reports, Reporting at different Levels of Management. |

|||