Financial Institutions and Market - वित्तीय संस्थाएँ और बाज़ार

- Description

- Curriculum

- Reviews

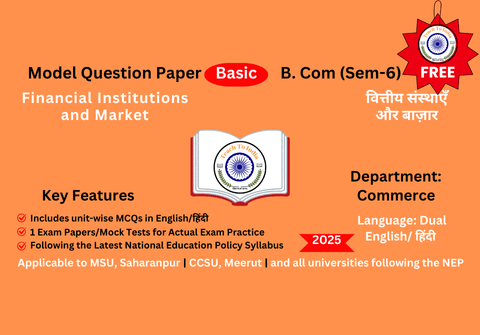

Model Question Paper

Financial Institutions and Market – वित्तीय संस्थाएँ और बाज़ार

Key Features | मुख्य विशेषताएँ

- Bilingual Model Paper | द्विभाषी मॉडल पेपर

- Enough MCQ for Practice | अभ्यास के लिए पर्याप्त MCQ

- Exam Practice Paper with Mock Tests | मॉक टेस्ट के साथ परीक्षा अभ्यास पत्र

- Latest Syllabus as per NEP | NEP के अनुसार नवीनतम पाठ्यक्रम

- Designed by Experts | विशेषज्ञों द्वारा तैयार किया गया

The given MCQs cover only 10% of the syllabus | दिए गए बहुविकल्पीय प्रश्न केवल 10% पाठ्यक्रम को कवर करते हैं।

To cover 100% of the syllabus with summaries, upgrade to our Advanced Model Paper.| पूरा सिलेबस और सारांश कवर करने के लिए हमारा एडवांस मॉडल पेपर जॉइन करें। Join Advanced Model Paper

-

Program Class: Degree/ B.Com.

Year: Third

Semester: Sixth

Subject: Commerce

Course Title: Financial Market Operations/Financial Institutions and Market

Course Learning Outcomes:

· Ability to understand the concept of Financial Market along with the basic forms and norms of Financial Market.

· Ability to understand the terminologies associated with the field of Financial Market and control along with their relevance.

· Ability to identify the appropriate method and techniques of Financial Market for solving different problems.

· Ability to apply basic Financial Market principles to solve business and industry related problems.

· Ability to understand the concept of Primary and Secondary Market, Stock Exchange, SEBI etc.

Credits: 5

Core Compulsory

Max. Marks: 25+75

Min. Passing Marks: 10+25

Unit

Topics

I

Financial Markets an Overview: Meaning of Financial Market and its Significance in the Financial System. Financial Markets in the Organized Sector – Industrial Securities Market, Government Securities Market, Long-term Loans Market, Mortgages Market, Financial Guarantee Market, Meaning and Structure of Money Market in India, Characteristics of a Developed Money Market, Significance and Defects of Indian Money Market.

II

Capital Market: New issue market – Meaning and Functions of New Issue Market, Instruments of New Issues, Players and their role in the New Issue Market, issue-pricing and marketing. Defects and Remedies of New Issue Market.

III

Secondary market: Functions and role of stock exchange; Listing procedure and legal requirements; Public Stock Exchanges-NSE, BSE and OTCEI. Functionaries on Stock Exchanges: Brokers, Sub brokers, market makers, jobbers, portfolio consultants, institutional investors.

IV

Investor Protection: Grievances concerning stock exchange dealings and their removal, Demat Trading. SEBI Guidelines – Primary Market, Secondary Market and the Protection of investor’s interest, NCLT & NCLAT.

-

1Unit 1: MCQs - Financial Market OperationsFinancial Institutions and Market

-

2Unit 2: MCQs - Financial Market OperationsFinancial Institutions and Market

-

3Unit 3: MCQs - Financial Market OperationsFinancial Institutions and Market

-

4Unit 4: MCQs - Financial Market OperationsFinancial Institutions and Market